Support in selling your business

Fasten your seatbelts

Support in selling your business

Do you ever think about selling your business? Once comes the time for you to evaluate the future prospects and ownership of your business. This can be a major and emotional decision and a complex process.

For entrepreneurs and companies “on the move,” Corpance is the dynamic advisor, financial expert and trusted advisor for sale counseling. Corpance’s advisors have already logged many flight hours.

Sales usually take place through:

- A business transfer: succession within the family or sale to a third (strategic) party;

- Acquisition by incumbent management (management buy out);

- Acquisition by someone from outside who takes over management and ownership (management buy in).

Sometimes a merger is applicable. This involves combining the assets and liabilities or shares of companies and then proceeding under joint management.

As a process supervisor and ‘co-pilot’, we will relieve you of worries during the entire sales process, without you as ‘pilot’ relinquishing control.

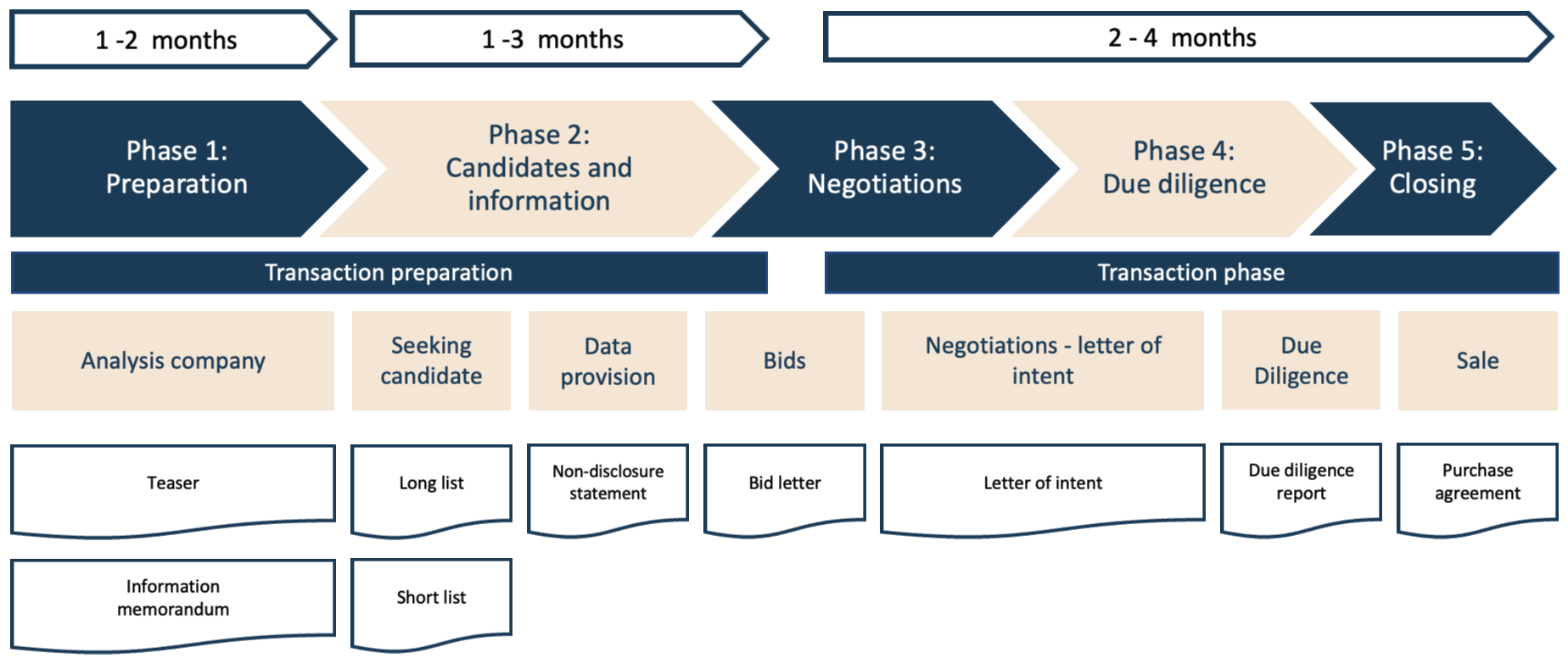

Steps sales process

The entire sales process consists of the following steps:

1. Preparing your company to be sold

2. Value indication

3. Preparation of sales documentation

4. Approach prospective buyers

5. (Exclusive) negotiations

6. Due diligence

7. Closing

8. Follow-up

If a prospective buyer is already in the picture, the above process can be shortened and/or some steps are not applicable.

Getting ready for sale

Getting ready for sale involves several years in some cases, and requires specific knowledge of taxation, law (legal structure), business economics and organisation. We work with you to arrive at an optimal structure with a view to value maximisation and personal preference. All the more reason to start thinking about selling in advance.

Value indication

We calculate the value indication of your company, and discuss your expectations of the selling price and its feasibility.

Preparation of sales documentation

In this phase, we prepare the information memorandum, based on a financial and other business analysis and any additional discussions with management. We will also prepare create a teaser, which is an anonymous brief profile of the object to be sold, which we can use to make an initial approach to prospective buyers.

Approaching prospective buyers

More or less at the same time as we prepare the sales documentation, we will, in consultation with you, draw up a long-list of potential prospective buyers. A select group of prospective buyers is usually selected for an initial round of candidates to be approached (short-list). If there is further interest, prospective buyers will receive the information memorandum after screening and signing a non-disclosure agreement.

(Exclusive) negotiations

We aim to get the best price and good framework conditions. There may be several parties interested in acquiring your company. After evaluating and selecting the most optimal bids, a choice will be made in consultation with you regarding which party you wish to pursue negotiations with on an exclusive basis. A letter of intent follows, prepared by a specialised lawyer or attorney. We read through it with you and ensure that the agreed price and preconditions are correctly reflected in the letter of intent.

Due diligence

The buying party is given the opportunity to carry out an audit. We facilitate this for you through an online platform. On a satisfactory outcome of the audit, the purchase agreement can be prepared. Also here we read through it with you and adjust where necessary.

Closing

With a final purchase agreement, the notarial transfer takes place and the transaction is completed. ‘Close the gates’!

Aftercare

Even if the ‘gates are closed’, the buyer may still expect guarantees and management performance from the seller. We also pay attention to emotional follow-up. What will you do after selling? Do you have any plans? How does the sale fit within the family, etc.? We are prepared for a good landing, so that the seatbelts can be unbuckled again.

We look forward to seeing you on board!